Rising Coin Game Theory

Rising Coin is a unique and revolutionary approach to stock to flow ratio and production cost attribute of a commodity, which will result in an unusual supply and demand dynamic.

Basic Idea

Rising Coin project’s main idea is to reverse the production cost attribute to be on the top of the market rather than the bottom of the market, and keep it increasing at a daily 1% rate with respect to USD, under control of smart contracts. As a result, there will be a defined daily top price which the market price can not pass to the upside, but this daily top price will increase quite fast with time.

How Does It Work

The production cost, which is the top price of Rising Coin, will be fixed during the day. If the market price reaches the production cost, instead of moving above it, market price will be limited by fresh supply. When the day switches to the next one, Rising Coin production cost will be increased 1% relative to previous day, with respect to USD.

The project will start with very small supply and the supply will increase only if there is enough demand that wants to buy from production cost, which is the historic all time high (ATH) price.

| As price can never pass the production cost and as production cost increases algorithmically every day, production cost always acts as an All Time High (ATH). |

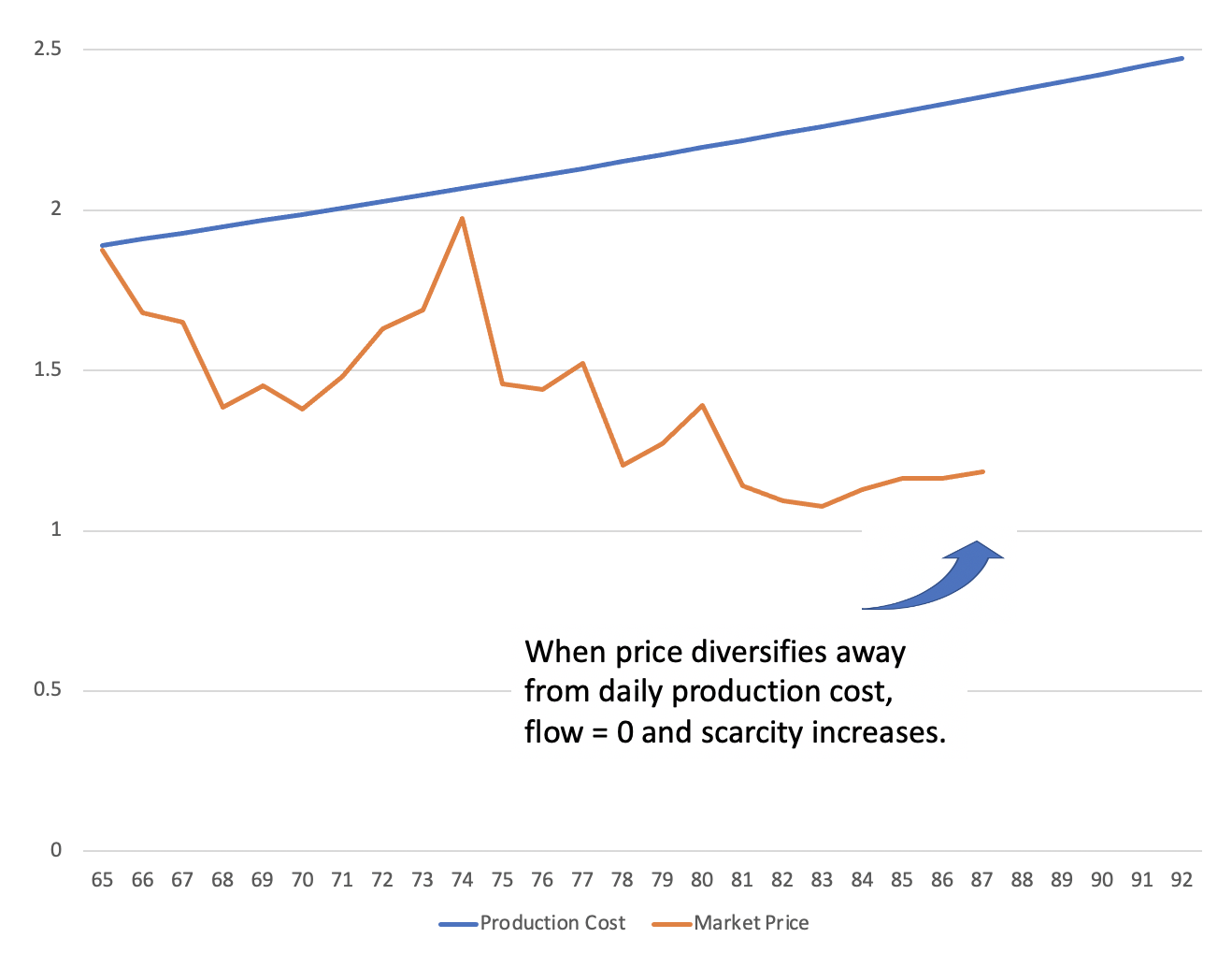

Normal or Low Demand

When market price is below the daily production cost, i.e. top price, price discovery will work in a normal way, as a balance between supply and demand; hence the price will be free to fluctuate between zero and daily production cost. If there is no new demand in the market, the coin supply will stay fixed, i.e. there will be no flow, which will be a positive effect on scarcity.

Production cost will always keep increasing 1% per day. If market price stays low, then as time goes on, the difference between market price and production cost will increase, causing a situation where the production cost of an asset keeps increasing while its market price keeps low. Every day market price will look cheaper and cheaper and it will be more logical to buy and hold.

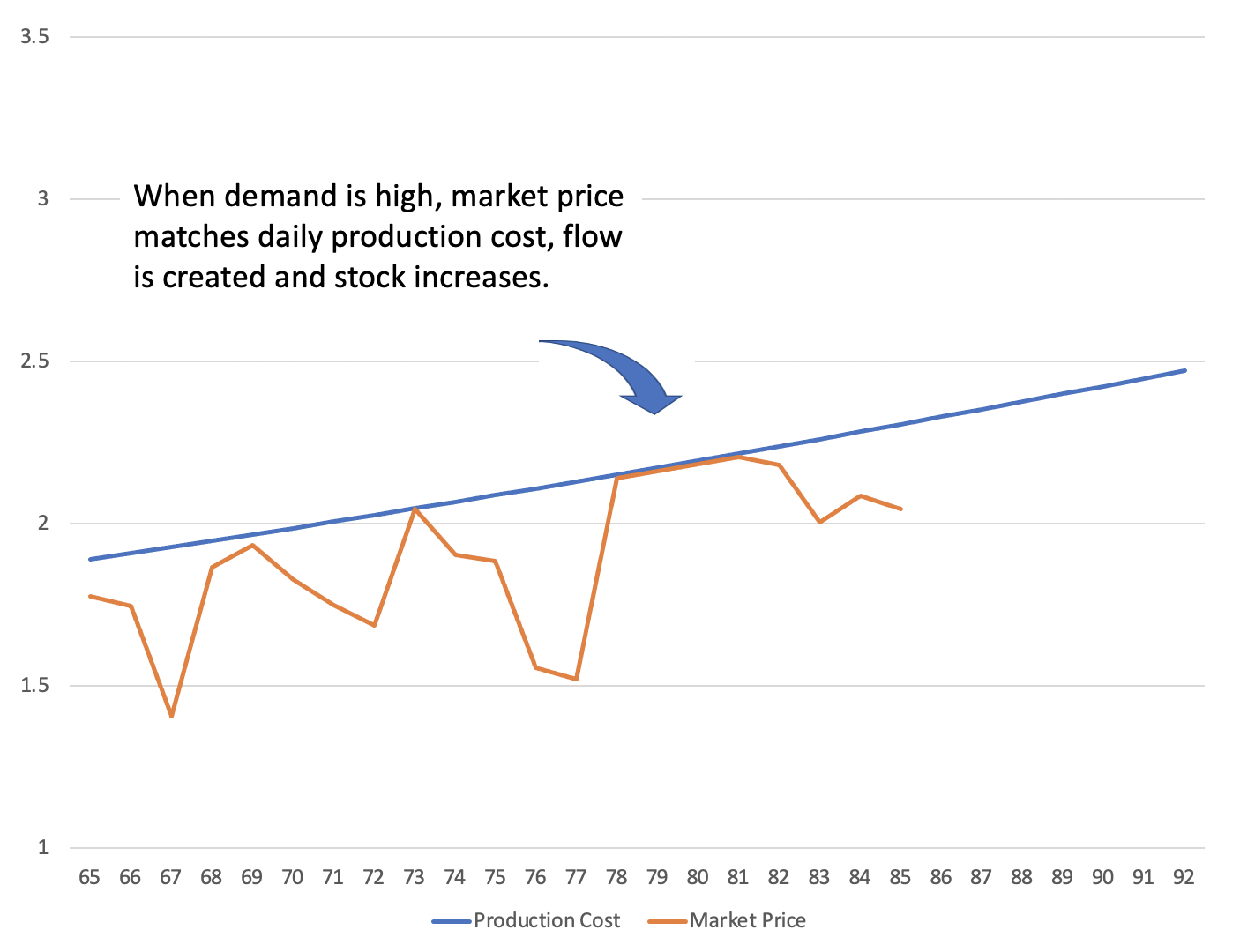

High Demand

When the demand in the market is high enough to consume all the sellers up to the production cost, instead of a price spike, new coins will be minted and sold to the market at the production cost. As a result, flow will be generated and scarcity will be affected negatively. But this can only happen when the market is at its historic ATH, so the negative effect of adding supply on price will be quite minimal.

Infinite Supply… Or not?

Rising Coin production cost will start at $1 and increase 1% daily. The daily increase might look quite small but when it is considered over a long time frame, it will be quite high; 1% daily increase is equivalent to an increase of about 37 times per year. As a result, the daily increase of production cost will make it harder and harder to add new supply. Although there is no mechanism to put a hard limit on the supply, it will be exponentially harder to add new supply as time passes; the same amount of money can increase the supply 1 / 37th of the amount it could increase it one year ago, and 1 / 1,370th of the amount it could increase it two years ago.

To put it in another perspective, at the project start date when coin price is $1, 1 million dollars can add 1 million RC supply. One year later, same 1 million dollars can add about 26,500 RC supply, and another year later, 1 million dollars can add only about 700 RC supply.

We can conclude that although coin supply looks unlimited, it will be exponentially harder to add new supply as time passes.

Anchoring Effect

We expect that the production cost located on top of the market will have an anchoring effect on the market price of Rising Coin. When price diversifies away from the production cost, loss of flow will make RC more scarce and act as an upwards push on price.

The attributes of production cost, being on top of the market and increasing with time, will create a psychological effect on traders. When they sell low, each day their sell price will move away from the production cost. Traders will have to keep increasing their sell target to keep up with the production cost.

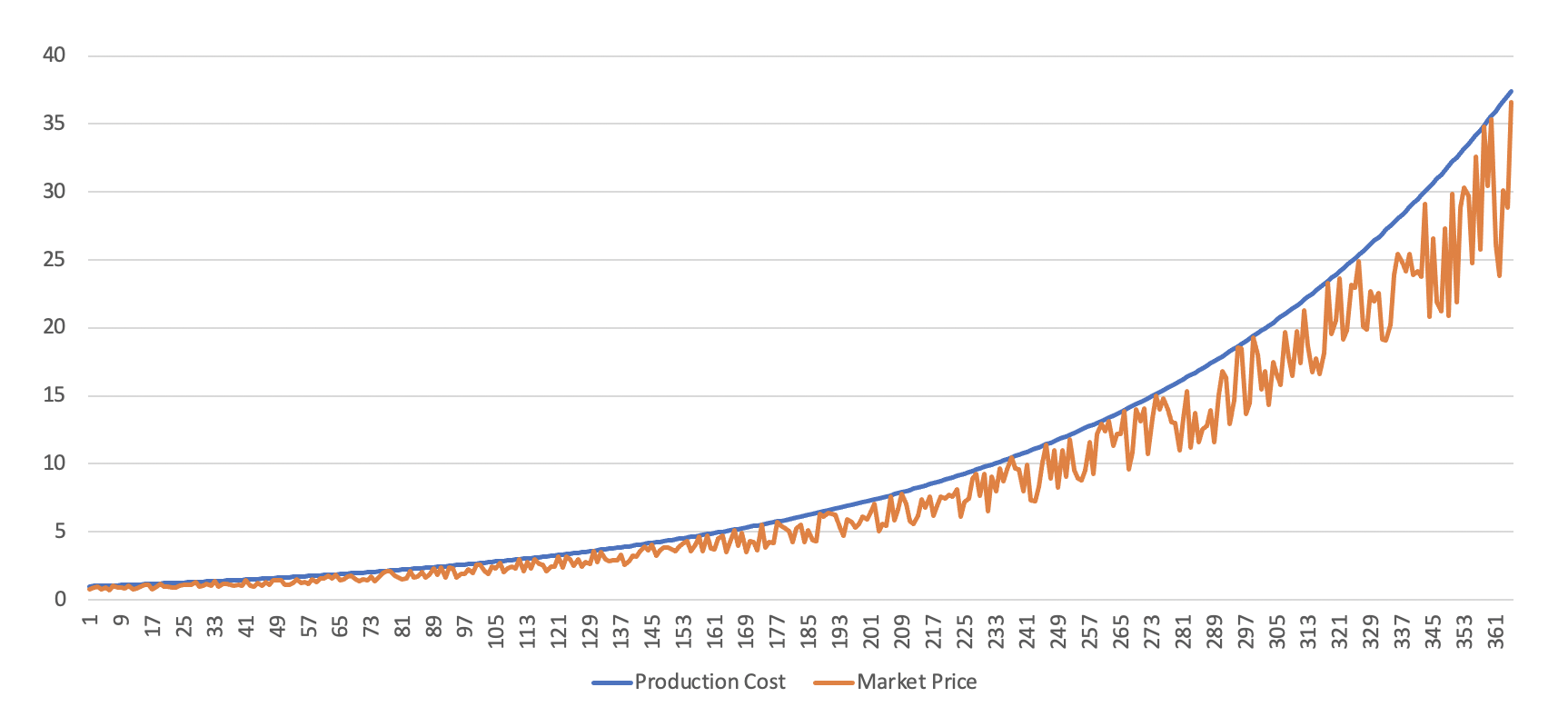

The expected long term price behaviour will look similar to the image below, where market price will diversify from production cost for a while but will always have a tendency to return back to it.